EliteAlgo Algorithms

In trading, time is a key element.

Business success requires not only deep knowledge and discipline, but also emotional resilience that many people are lacking in the manual trading.

The EliteAlgo algorithms will sort this out for you and automate the whole trading process. Earning on the stock market has never been easier.

Advantages of trading with EliteAlgo

Quick and efficient start of trading

No need for previous experience

Trading process completely managed by algorithm

Emotional resilience and objective decision-making

Algorithm keeps eye on compliance with the rules

Zero time required to operate the system

Specialization of EliteAlgo Systems

Centralized exchange trading

The key to success is strategic trading in a stable and fair environment.

Our EliteAlgo algorithms leverage one of the largest centralized exchange ecosystems in the world – CME Group. We cooperate with a reputable brokerage company, Interactive Brokers, which ensures equal conditions for all traders.

S&P500 specialization

We focus on global market, especially on US Index S&P500. The EliteAlgo algorithms have a proven statistical advantage in market volatility analysis with up to 80% probability of success. We use S&P500 e-mini/micro futures contracts and options contracts, which are key to minimizing risk and maximizing returns.

Business transformation and optimization

Our algorithms open neutral trades. We are simultaneously present in long and short positions, allowing us to efficiently improve trading statistics and control the risk.

Verified strategies with no need to create your own

We offer you access to verified trading strategies to facilitate better results and mitigate the risks. With EliteAlgo, you can start trading with functional systems instantly with no need to create your own strategies, find a statistical advantage or undergo a time consuming testing. We have already prepared all of these for you.

Currently available algorithms:

LiveAlgo

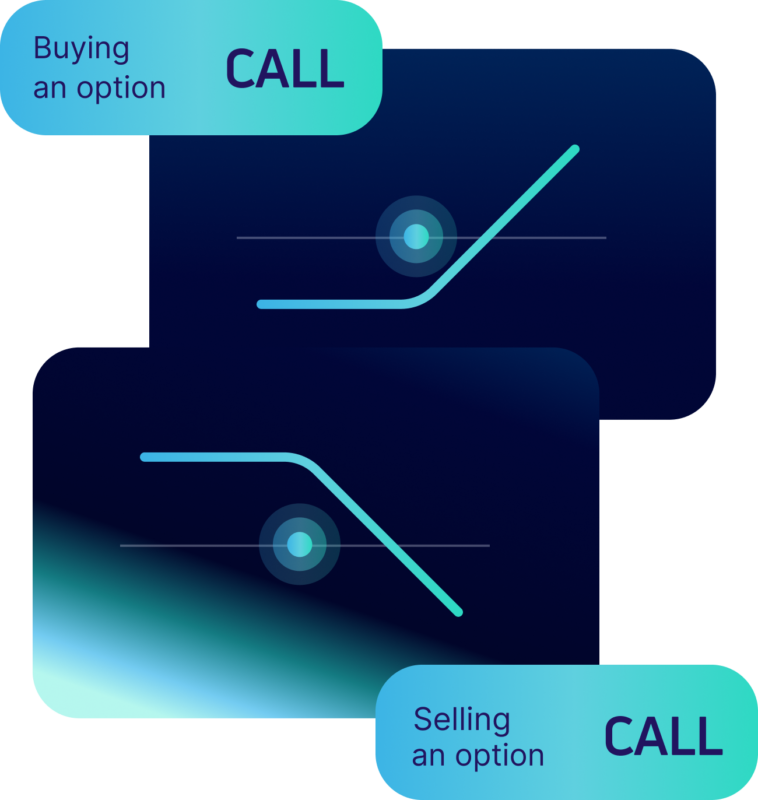

Go Live!LiveAlgo is a pilot fully automated algorithm from the EliteAlgo family, designed as a systematic solution for consistent trading. Its unique approach is to enter both sides of the market simultaneously – long and short – through options, which are the only ones that allow this structure.

Trades are executed exclusively in the average volatility range of the S&P 500, which provides stable and predictable market conditions. The strategy is delta-neutral, i.e. independent of the market direction, and upon entry generates an immediate credit that sets the profit zone. The market can move arbitrarily within this range – up or down – and the trade remains profitable.

To protect against extreme market fluctuations, the strategy is secured by futures hedging, which significantly reduces risk. LiveAlgo thus represents a balanced and long-term sustainable approach to trading with clearly defined risk and stable growth potential. Thanks to systematic capital management and robust performance in various market conditions, it offers an efficient and disciplined way of trading.

| Evaluation: | ⌀ 12.11 % p. a. |

|---|---|

| Maximum drop: | -6,63 % |

| Risk-Reward Ratio: | ⌀ 3,8 |

| Market: | MES/ES FOP + Futures |

| Strategy type: | Neutral |

| Minimum capital: | 5000 USD |

| Trade frequency: | 1x za týden |

| Brokerage company: | Interactive Brokers |

| Výhody: |

performance

stable results

risk profile

market adaptability

suitable for small accounts

|

| Omezení |

less suitable in too low or too high market volatility

|

Launch the LiveAlgo presentation

(8:54)

Want to start using the EliteAlgo algorithms?

This possibility is available only with active Go Live! membership. Do not hesitate and join Eliteways today!

Find out what you can earn with us

© 2025 Eliteways. All rights reserved.